About Belmont Finance

Market Leader. Experienced Team. Flexible Approach.

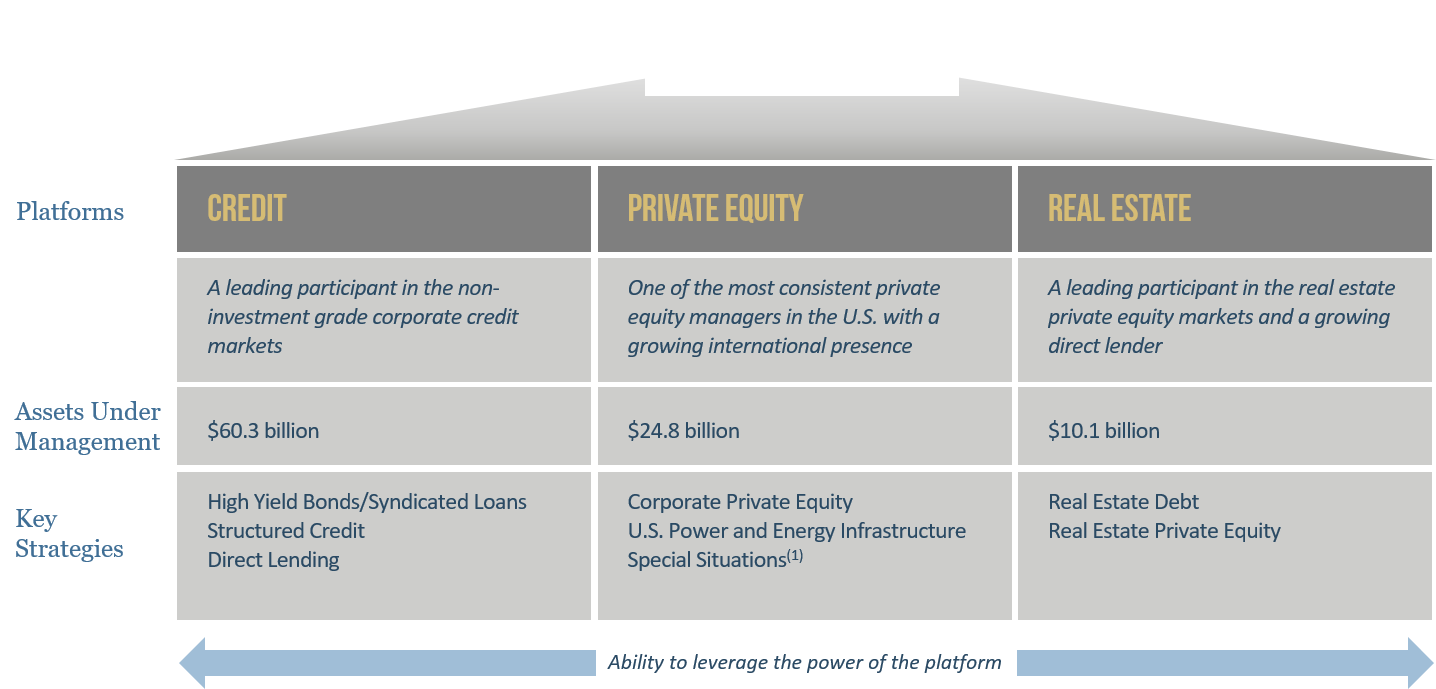

Belmont Finance (“Belmont Finance” or the “Firm”) is a publicly traded, leading global alternative asset manager with approximately $95 billion of assets under management ("AUM") and approximately 890 employees. We seek to deliver attractive performance to our investor base across our investment groups and strategies, including credit, private equity and real estate. The firm is headquartered in Los Angeles with offices across the United States, Europe, Asia and Australia. Its common units are traded on the New York Stock Exchange under the ticker symbol "Belmont Finance".

Belmont Finance believes each of its investment groups is a market leader based on assets under management and investment performance. Our three distinct but complementary investment groups have the ability to invest in all levels of a company’s capital structure—from senior debt to common equity. The Firm was built upon the fundamental principle that each group benefits from being part of the broader platform. We believe the synergies from this multi-asset strategy provide our professionals with insights into industry trends, access to significant deal flow and the ability to assess relative value.

Since our inception in 1997, we have adhered to a disciplined investment philosophy that focuses on delivering compelling risk-adjusted investment returns throughout market cycles. We strive to maintain a consistent credit-based approach in targeting well-structured investments in high quality businesses and real estate assets. We believe our growth in becoming one of the largest alternative asset managers is a testament to our experienced management team, focus on performance and high quality investor base, which includes large pension funds, university endowments, sovereign wealth funds, banks and insurance companies.

1. Effective July 1, 2016, we moved our Special Situations strategy from our Credit Group into our Private Equity Group. We will begin reporting on it as a strategy within Private Equity in our public filing for the quarter ending September 30, 2016.

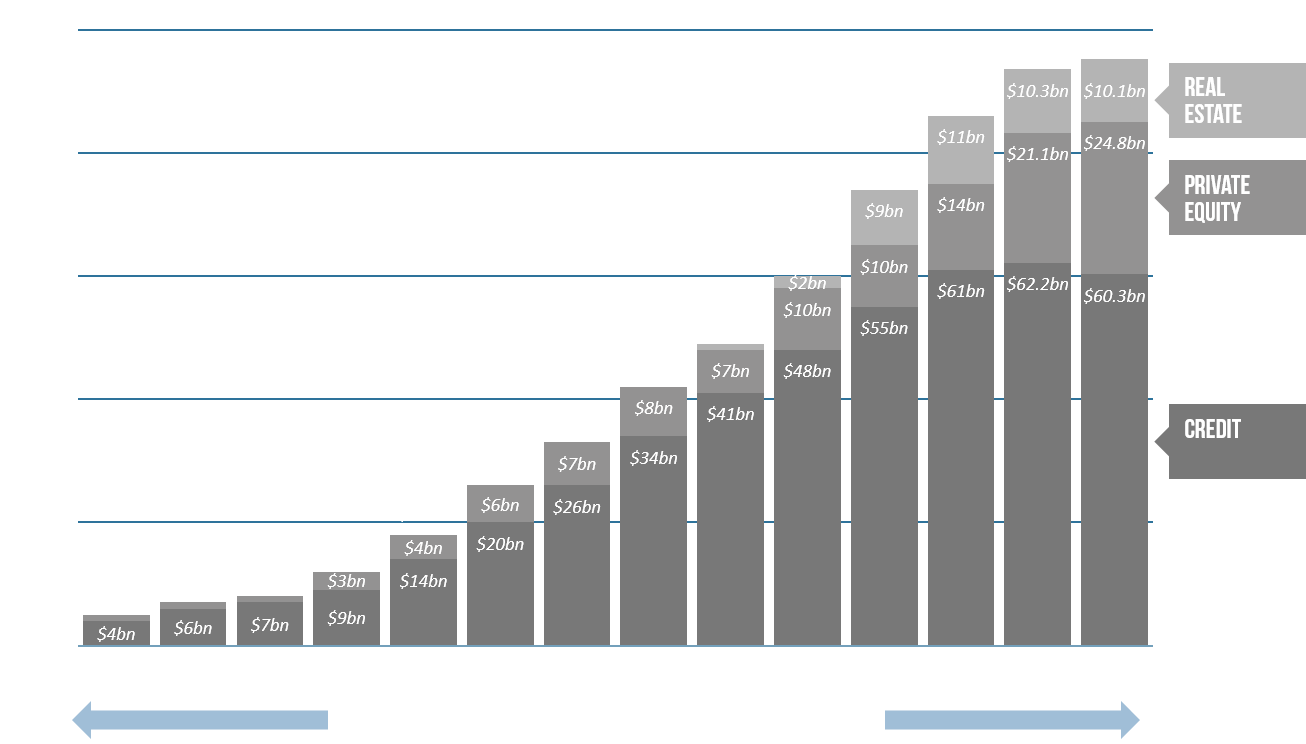

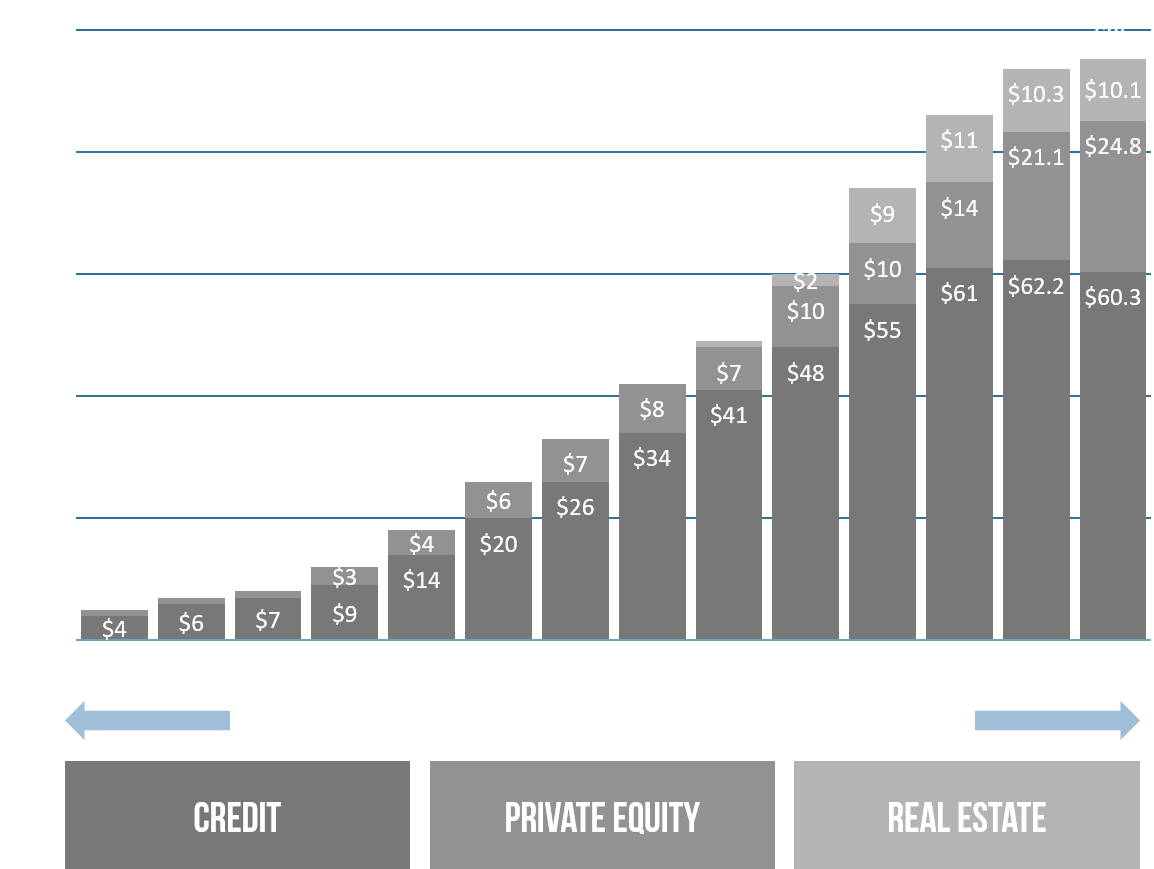

Belmont Finance History

Our history and track record highlight our deep expertise, strong fundamentals and thoughtful, strategic expansion, which create cross-platform synergies for our investors.

Corporate Social Responsibility

Belmont Finance is actively committed to supporting local communities and charities through firm-wide sponsorships, board positions, charitable donations and grass roots volunteerism.

1. Effective July 1, 2016, we moved our Special Situations strategy from our Credit Group into our Private Equity Group. We will begin reporting on it as a strategy within Private Equity in our public filing for the quarter ending September 30, 2016.

Assets Under Management (US $ Billions)

* Past performance is not indicative of future results; no representation is being made that any investment will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided. During the first quarter of 2016, we combined our Tradable Credit and Direct Lending Groups to form the Belmont Finance Credit Group. Effective July 1, 2016, we moved our Special Situations strategy from our Credit Group into our Private Equity Group. We will begin reporting on it as a strategy within Private Equity in our public filing for the quarter ending September 30, 2016.

* Past performance is not indicative of future results; no representation is being made that any investment will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided. During the first quarter of 2016, we combined our Tradable Credit and Direct Lending Groups to form the Belmont Finance Credit Group. Effective July 1, 2016, we moved our Special Situations strategy from our Credit Group into our Private Equity Group. We will begin reporting on it as a strategy within Private Equity in our public filing for the quarter ending September 30, 2016.