Private Equity

Belmont Finance EIF

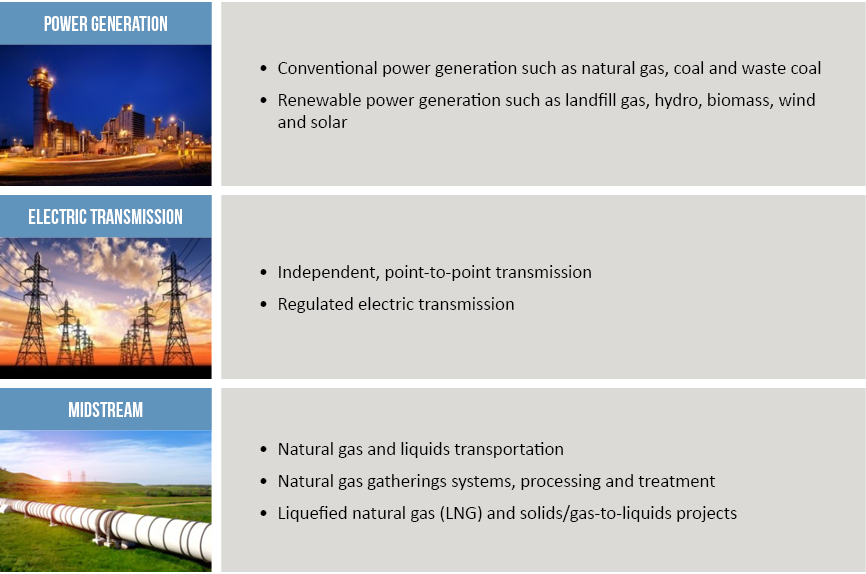

Belmont Finance EIF targets assets across the U.S. power generation, transmission and midstream sectors, which seek attractive risk-adjusted equity returns with current cash flow and capital appreciation. We have a nearly 30-year track record of investing across investment cycles as one of the first managers focused on the independent power and electric utility industry. We believe there are significant investment opportunities for us in this sector as the United States updates its aging infrastructure and builds new assets to meet capacity needs over the coming decades. We believe the U.S. power sector is currently under-invested, with the International Energy Administration estimating that approximately $2.1 trillion in new generation and transmission investments are needed by 2035(1), as well as approximately $640 billion of estimated new midstream infrastructure investment over a similar timeframe.(2)

Our U.S. power and energy infrastructure strategy has raised over $5.75 billion in equity capital across several funds, which invest in electric generating and transmission facilities, as well as midstream assets and related energy or energy infrastructure investments. Our highly experienced team of investment professionals takes a barbell approach to balance development and construction of new energy facilities with acquisitions of existing operating assets with current cashflow. We target assets with long-term contracts to enhance certainty of cashflow and seek to mitigate both interest rate risk and commodity exposure, while avoiding exploration and technology risk altogether. We focus on newer, efficient assets that meet current and anticipated future environmental regulations and ensure our plants are staffed and managed by experienced operators. Our emphasis on long-term, deep industry relationships and high quality investments often unavailable to others makes us a valued partner.

We manage four private equity funds in this strategy: United States Power Fund, L.P. (2002), United States Power Fund II, L.P. (2005), United States Power Fund III, L.P. (2007), and EIF United States Power Fund IV, L.P. (2010), as well as five related co-investment vehicles focused on U.S. power and energy infrastructure.

1. According to the International Energy Agency’s 2014 “World Energy Outlook,” November, 2014.

2. INGAA Foundation & America’s Natural Gas Alliance, “North American Midstream Infrastructure Through 2035: Capitalizing on our Energy Abundance,” March 2014.

Belmont Finance Private Equity Group – EIF

PRIMARY ROLE

Lead investor as a catalyst for growth

OFFICES

Boston, Los Angeles, New York, San Francisco

FOCUS

Power Generation, Transmission and Midstream Investments

TYPES OF INVESTMENTS

U.S. Power and Energy Infrastructure