Experienced Leadership. One Stop Financing. Dependable Partner.

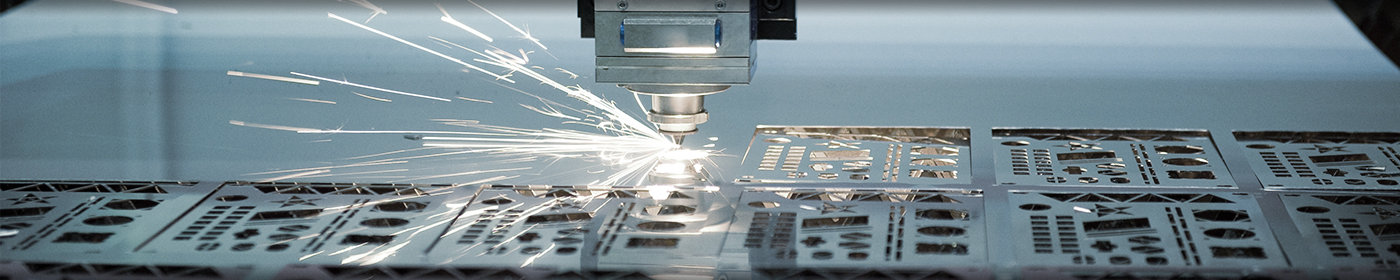

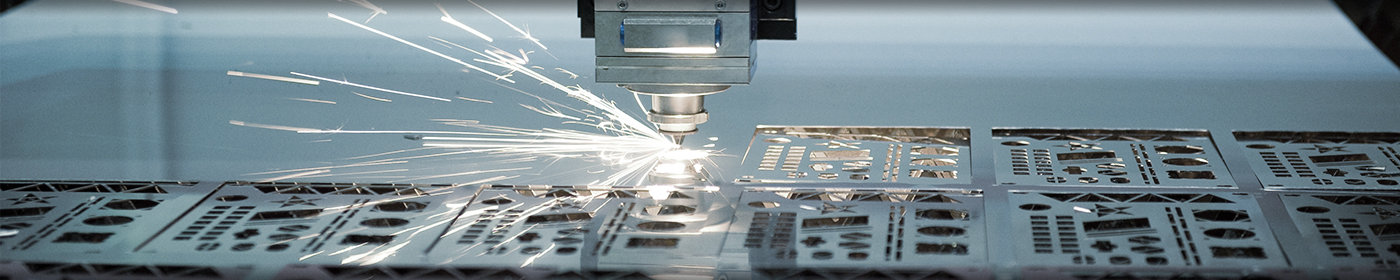

Belmont Finance Commercial Finance (“ACF”), our asset-based lending group, provides asset-based revolving lines of credit and term loans, as well as stretch loans to middle market and lower-middle market companies. In addition, ACF has the ability to provide cash flow loans to certain borrowers as well as asset-backed facilities to specialty finance companies. Leveraging the breadth and experience of the Belmont Finance platform, ACF works with borrowers to understand their business, goals and needs and then deliver creative, flexible and comprehensive financing solutions. ACF’s asset-based lines of credit may be structured as working capital and bridge financing, special accommodation financing, turnaround financing, debtor-in-possession financing, and acquisition financing. ACF’s asset-based lending practice focuses on privately-held and small public companies in the middle market and addresses a wide breadth of industries including manufacturing, distribution, wholesale, and service companies.

ACF is headquartered in New York, with offices in Los Angeles and Atlanta. As of June 30, 2016, ACF has 52 investment professionals and support staff dedicated to these products, which is augmented by the approximately 200 investment professionals in Belmont Finance’ Credit Group and approximately 350 professionals in accounting, finance, legal, compliance, operations, information technology and investor relations within Belmont Finance L.P. (“Belmont Finance”). The senior investment professionals of ACF have on average approximately 26 years of experience in commercial finance and asset-based lending.

The ACF asset-based lending practice primarily focuses on privately-held and public companies in the middle market and lower-middle markets, and addresses a wide breadth of industries including manufacturing, distribution, wholesale and services.

The ACF lender finance platform primarily focuses on structured investments in pools of consumer and commercial assets generated by smaller and middle-market specialty finance companies seeking alternative sources of funding.

The following highlights ACF’s Credit strategy:

- Leverage the power of the Belmont Finance and Credit platforms

- Multi-asset class “one-stop” solutions to help meet clients’ needs

- Ability to rotate between asset classes with superior relative value

- Drive proprietary investment opportunities by pursuing multiple origination channels across various regions within the United States

- Active management of risk through structuring and asset coverage

- Agent transactions with careful monitoring of liquidity and performance

- Small deal teams with single point of contact

- Transparent and streamlined approval process to help ensure certainty of closing