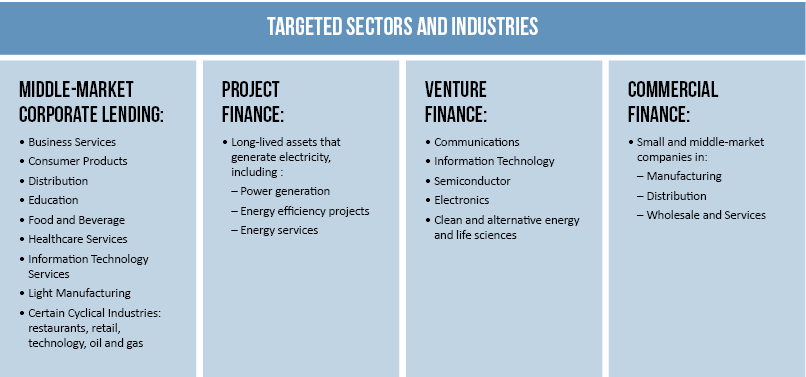

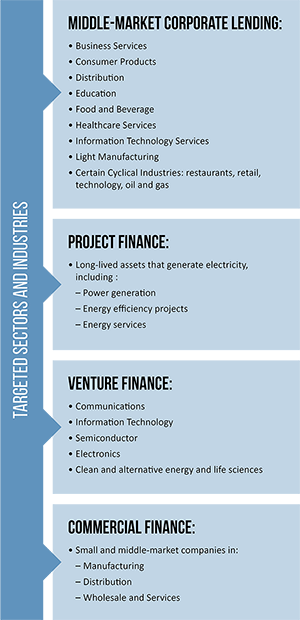

We provide financing to middle-market corporate borrowers across a range of industries, as well as project finance, vendor finance and commercial finance (asset-based and cash flow loans to small and middle-market companies). We are a long-term, value oriented direct lender, targeting companies with a history of stable cash flows, demonstrated competitive advantages and experienced management teams. We place a high priority on market-leading companies with identifiable growth prospects that we believe can generate significant free cash flow.

Our investment strategy relies heavily on intensive due diligence, structuring expertise, disciplined underwriting and active portfolio management. We prefer to agent and/or lead the transactions in which we invest. We also seek board representation or access as appropriate in order to enhance our ability to achieve our investment strategy and to be a more value-added partner for our portfolio companies. We believe this approach enables us to identify attractive investment opportunities throughout economic cycles and across a company’s capital structure so we can make investments consistent with our investment objectives and preserve principal while seeking appropriate risk adjusted returns. We also selectively consider third-party-led senior and subordinated debt financings, review portfolio purchases and opportunistically consider the purchase of stressed and discounted debt positions.